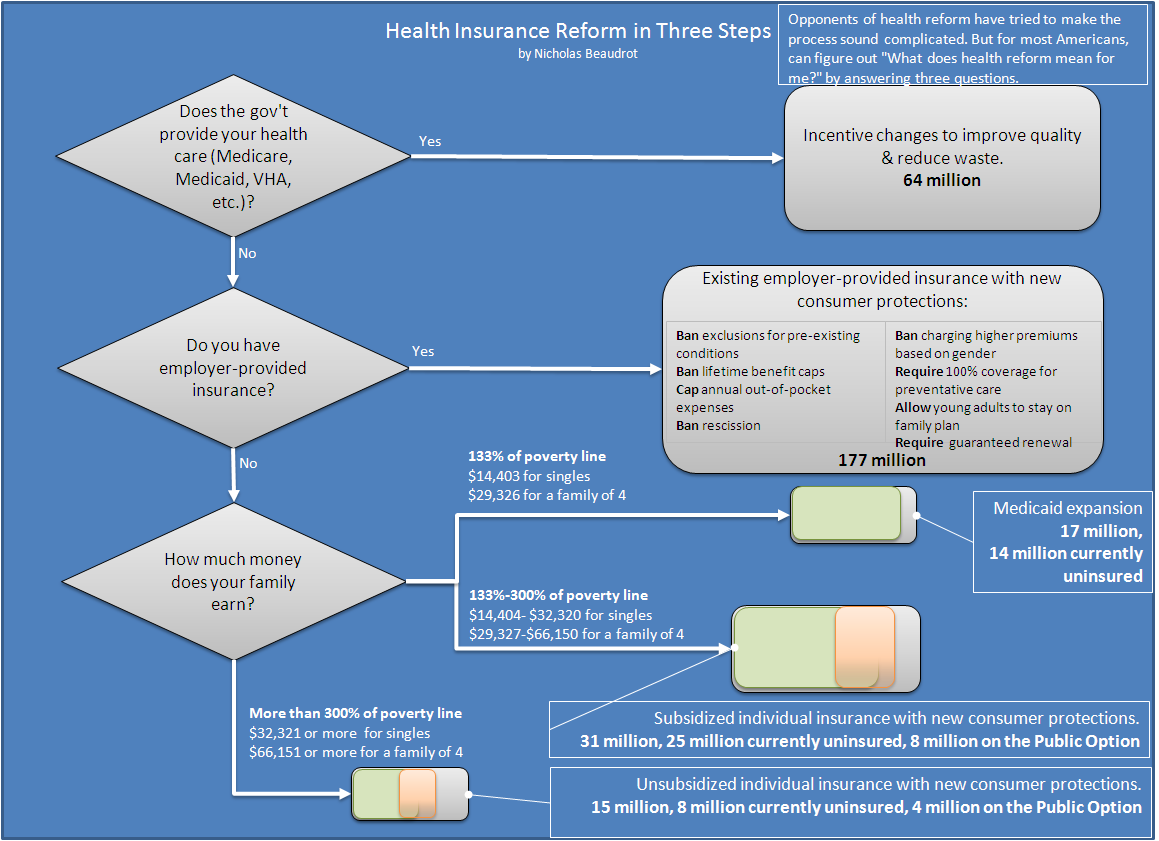

Using 3 simple questions, Nicholas Beaudrot has put together a nice infographic explaining the proposed health care reform plans. However it doesn’t answer how the death panels are going to deal with poor old granny, funny how they don’t address gramps.

How many people will be answering “Yes” to that second question when the government gets in the game?

You gotta love all of the ‘consumer protection’ mandates listed under existing employer-provided insurance. Do you think this might INCREASE costs?!?

It’s kind of like those ‘consumer protections’ they put on credit card companies. In the name of protecting some irresponsible people, credit card companies had to raise rates, discontinue rewards, and/or impose annual fees on responsible people who paid their bills on time. I’m not defending credit card companies, or insurance companies, but in both instances by government meddling to “protect” a few, the burden is simply shifted to others. No costs will be lowered.

Funny how this chart doesn’t seem to mention that you cannot opt out of insurance, regardless of income, under the new plan. Why do people *have* to have health insurance? Rich people can pay for services directly. Poor people may be better off spending their money on food and shelter.

Also, there’s a healthy amount of patriotic outrage in me when I consider the federal government forcing people to be covered by health insurance. It’s not like auto insurance, which you can avoid having by not driving a car, or like income taxes, which you can avoid paying by not making an income. There is nothing you can do under this plan to *not* get health insurance. As an American, I should have the right to choose. The flip side of this, of course, is that people who elect not to have health insurance should not be surprised when huge medical bills arrive or when some procedures simply cannot be done.

Now, Health Care Reform that solves the “airline-ticket problem” (no two people pay the same amount for the same service) in health care–that would be worth considering. Private individuals shouldn’t pay more simply because they don’t have insurance. Medical costs should be like groceries. Everyone pays the same amount for the same milk.

And that’s enough analogies for today.

I can’t say that I agree with the same price for all idea. I think a very good argument can be made for not allowing genetic conditions to effect premiums. But someone who chooses to things that are detrimental to their health should have to pay more. Smoking is the perfect example – smoking increases healthcare costs that should not be paid for by non-smokers.

There are certainly that are not so clear – at what point is weight genetic vs. a choice. Mild diabetes and high blood pressure both can cause health problems and in some cases, can be dealth with solely by behavior/individual choices and in others, are genetic and require drug treatment.

I was specifically referring to goods and services such as prescription medicines, lab tests, specialist consultations, etc. These things should not cost more for people who do not have insurance than for folks who have it. The next time you pick up a prescription at the pharmacy, just for fum ask them how much it costs with and without insurance. I’ve seen it differ as much as a factor of 2. And I’m not referring to co-pay vs. full price, but rather the actual “retail” value of the drug.

The cost of insurance itself–well, that I agree should probably be risk-based and I have no beef with a system that grades risk via factors that we can control (smoking, drinking, extreme sports, etc.).

Gotcha – I took it the wrong way. You’re absolutely right, goods & services shouldn’t be priced differently depending on insurance coverage. The whole idea of co-pays was to make healthcare users aware that the services do in fact have a price even if they aren’t paying for it directly. But the fact of the matter is that consumers of care are still so isolated from the costs – not only do we pay different things for the same goods & services, but in most cases, we don’t even know what they do cost – that our action and behavior contribute to price inflation and a shortages.

How about age? This is a big determinant of health care premiums. Do you think that a 30 year old should pay the same as a 40 year old, 50 year old or a 60 year old? All of which are ages that need coverage before Medicare, a government program I might add, kicks in. As a consumer in the individual private health insurance market, I dread my next age bracket leading to a couple of thousand dollars increase in premiums, followed by the bracket after that going up even higher.

Having worked in the insurance industry at one point in my career, I understand that the concept behind insurance is risk sharing and underwriting for this. If the pool of insureds isn’t big enough or the risk pool is too great you are setting yourself up for problems as an insurance company.

My solution – single payer, national health insurance. Forget the public option, go forward with a plan that really attacks costs and equalizes benefits as you have suggested Cari. Once it is in place, you don’t have to use it, but if you find you have cancer or break a leg or have hypertension or diabetes or… you’ll be very happy to have the government insurance there to serve your immediate needs without having to shop for the service.

One of my biggest gripes is that health insurance isn’t really insurance anymore it’s become so much larger than that. I want health insurance to be like auto or life insurance. Purchasing auto or life insurance is relatively simple, and there are hundreds of companies competing and you can shop around for the best deal. Instead of health insurance to just cover major/catastrophic events that are relatively unlikely, it covers every single little thing (sprained ankle, cold, etc).

Stossel has a good piece on this, about how insurance makes healthcare more expensive.

The reason I bring this piece up – one of the core, fundamental problems is that when people don’t pay for something directly, they don’t care about the prices. When consumers don’t care about the price, costs go up. How does single government payer deal with this problem? I can only think of two possibilities: either it says, so costs go up, we live with it because that’s a cost of the system, or it dictates care and reimbursements to artificially control prices.