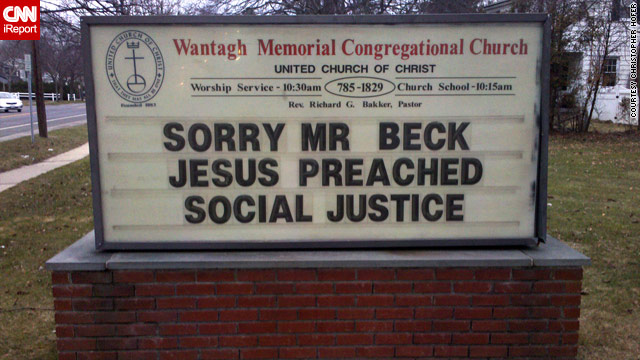

The Reverend Jim Wallis, president of Sojouners, a network of progressive Christians, has called for a boycott of Glenn Beck’s television show after Beck demonized churches that preach economic and social justice. Wallis has also challenged Beck to a public debate, saying that Beck perverted Jesus’ message when he called on Christians last week to leave churches that preach social and economic justice.

“He wants us to leave our churches, but we should leave him,” Wallis says of Beck. “When your political philosophy is to consistently favor the rich over the poor, you don’t want to hear about economic justice.”

According to Rev. Wallis, social and economic justice is at the heart of Jesus’ message, and in Matthew 19:21, Jesus said, “Go, sell what you have and give to the poor, and you will have treasure in heaven; and come, follow Me.” Sounds a lot like a plan to redistribute wealth, which conservatives have been screaming is socialism at its worst.

Oh, man, where to start?

Jesus was speaking to individuals in Matt 19:21, and later in Matt 25:31 – 46. This is very important to this conversation, and cannot be argued. His instructions were to his followers and not directed at any authorities.

I hate to break it to you, but trying to use the words of Christ to support COMPULSARY CONFISCATION of wealth is not only inaccurate, it is sinful. It’s twisting the words of the Lord to justify theft.

Christ had the ability to confiscate the wealth of people who did not follow him and redistribute it, but did not. That is instructive to the discussion. He was interested only in actions made by free will.

Christ’s message is not political or social, but deals with the condition and priorities of the soul. A follower who willingly and gladly gives his blessings to those less fortunate is displaying true faith.

You cannot equate forcible confiscation (by the government or by another man) with free will contributions. If you do, you make Christ a criminal and a sinner and a thief.

And for the record, in Matt 25:14-28, Christ actually endorsed the principles of capitalism, investment and interest. It is certainly not a “socialist” message, in any case.

Finally, Christ in many passages made it very clear that his message was not political, but spiritual as did the other writers of the Gospel. (Matt 22:21, Rom 13:1, Jn 18:36) Using his admonition in a political context is wrong. The good Reverend should probably spend some time asking for forgiveness in prayer.

Also, it is interesting that more recent evidence is coming to light that indicates that Peter was quite a wealthy individual, and may indicate that more of the disciples were as well.

We already know for a fact that Matthew was wealthy, and owned his own house. It is never shown in the Gospels where he gives his possessions away to the poor, either, further weakening the “socialist Jesus” position.

I will agree that Jesus’ was not a political being, but I find it very hard to deny his support of social justice…whether some of his disciples were wealthy or not, whether they gave away their possessions or not, Jesus wasn’t preaching to the economic or upper classes of his time. And although you may not agree with Pastor Wallis, I hope you aren’t defending Glenn Beck’s authority as a great Christian theologian.

At this point, leaving the discussion of Jesus behind, there has always been a redistribution of wealth in society. Before capitalism rose, that redistribution was from the peasant to the local lord to the royalty of the region or nation. If that had been standard practice for the first 200+ years of this nation, the country would have had a second revolution by now. But since the Reagan tax cuts and later the Bush II tax cuts, that is exactly the distribution we’ve seen…and why those most vocal in opposition to raising taxes on the top tier are those unlikely to be in that tier is beyond me.

The Reverend’s entire position rests on Christ as a political philosopher, which is a misuse of the Gospel and false teaching. False teachings of the Gospel are dangerous and sinful, whether they deal with “economic and social justice” (code for command socialism) or the condemnation of homosexuals as taught by Westboro Baptist Church.

Both are equally repugnant.

As for the Reagan and Bush tax cuts, you start from a flawed premise regarding the payment of taxes. Income taxes today are not actually paid in any amount by the bottom 2 quintiles of income earners. (Please see http://www.cbo.gov/ftpdocs/57xx/doc5746/08-13-EffectiveFedTaxRates.pdf – P.18-19 table). The bottom 40% pays less than 6% of ALL federal taxes (inclusive of FICA, etc.)

If an income tax cut is passed, it must then necessarily cut the taxes of those at higher quintiles as there is literally nothing to cut at lower quintiles. In fact, when you factor in the tax credits the lower 2 quintiles are eligible for, their total income tax liability is actually less than 0, indicating they receive larger refunds than they have withheld. In short, they MAKE money at income tax time.

How you can cut taxes on people paying a -2% effective individual income tax rate? You cannot, of course, do any such thing.

We have roughly 40% of income earners that pay NO income taxes what so ever. That renders your argument about the “rich only getting tax cuts” as moot since the “rich” are the only ones PAYING taxes. Arguments about “paying your fair share” ala Bill Clinton would in reality support an INCREASE in taxes on the bottom 40%, as they are clearly not presently paying their fair share, or any share at all. (I do not advocate that position, but use it to further illustrate the point.)

This data is from the CBO, and is not some analysis done by a right wing hack. It is supported with ongoing IRS data from year to year, if you care to do the digging and research.

Please make sure you understand the facts on income taxes before you make wild accusations about the unfairness of a tax cut.

I was not supporting either the position of Pastor Wallis nor the Westboro Church. But not being either God nor Jesus, I wouldn’t have the temerity to label someone as sinful.

“If an income tax cut is passed, it must then necessarily cut the taxes of those at higher quintiles as there is literally nothing to cut at lower quintiles.”

Agreed…but that doesn’t mean we need to cut the taxes of the top 10%. I have no qualms about making your 40% of the population who pay 6% of the taxes 50% of the population and increasing the rates on the top 10% to what they were pre-Reagan era to compensate. BTW: I am not in the top group nor am I in the non-payer group.

I don’t have time at the moment to track it down, but I believe there is a fair amount of literature extant that describes the continued divergence between the wealthy and the poor in this country along with the dissipation of the middle class. If you want to stop by and help with the vacuuming and scrubbing the kitchen floor, we can discuss this in greater detail!

Now we see the truth of the position of the left. Ed, why stop at 50%? Why not make the top 10% pay it all, and have the rest pay none?

Your statement exemplifies the typical progressive position. Simply stated, you believe that is some one else’s responsibility to pay for someone else, based on what they have.

Why not bypass the tax system all together, and just make it legal for the bottom 50% to raid the homes and bank accounts of the top 50% and take what they want. Seems like a much simpler arrangement.

As for income disparity, your premise fails on several fronts.

1) Taxes are not a determiner of income, they are reflective of it. That is to say, the poor are not poor due to taxes.

2) Income is determined by multiple issues unrelated to the fiscal or tax policy of any country.

In the case of the US, you should be examining a culture that does not value education, and actively denigrates those who do strive to educate themselves as “sell outs”, etc.

This same culture also looks favorably on dependence on the state at something not to be ashamed of. In fact, it is seen as not only acceptable, but is applauded.

Nearly all of what determines income for any individual is based on personal decisions, choices, attitudes, and aptitudes.

If an individual, or a community, decides that conforming to the overall culture is bad, education is a waste of time, and jobs are for other people, you cannot blame the tax code for their position relative to those who did not make those choices.

The people that comprise the top 50% are not there due to some stroke of luck. They are there because they made sound choices, valued education, valued employment, and sought to participate to their utmost in the economic world.

And you now advocate that we punish those people with higher taxes so we can reward people who made poor decisions and choices, that led them to the place they are today?

And spare me the tripe about the system being rigged. There are millions of immigrants to the US who have risen to the highest income brackets, while generations of people born here have not. Neither party had an advantage or disadvantage within the system. The one chose to work hard to achieve, and the other chose not to.

I cannot believe that America has become a place where the individual who takes full advantage of freedom and liberty and succeeds is now a villain to be punished, while those who do not do so are considered noble and is to be rewarded.

That is just sad, and is not the America that was intended 200+ years ago.

“1) Taxes are not a determiner of income, they are reflective of it. That is to say, the poor are not poor due to taxes.”

Probably not, but taxes certainly don’t help the situation. But then if we raise taxes on the top ten percent they won’t become poor either.

“2) Income is determined by multiple issues unrelated to the fiscal or tax policy of any country.”

I’ll beg to differ on this one. If this were true we wouldn’t hear that cutting taxes on the rich creates jobs or that raising corporate taxes causes businesses to move…

“In the case of the US, you should be examining a culture that does not value education, and actively denigrates those who do strive to educate themselves as “sell outs”, etc.”

Are we speaking about Republicans, Conservatives, the Religious Right, Tea Partiers and Palinistas? If so, I agree.

“The people that comprise the top 50% are not there due to some stroke of luck. They are there because they made sound choices, valued education, valued employment, and sought to participate to their utmost in the economic world.”

Yes, most people who are successful certainly share all of the traits you mention. But luck has a lot to do with it…and certainly being prepared allows them to make the most of the situation. Certainly we can agree that Bill Gates is an intelligent hard working individual who values education and has done his utmost in the economic world. But there was just a bit of luck involved when IBM selected his fledgling software company to developing the MS-DOS operating system for their new line of PCs. Otherwise he might just as easily been another bright software engineer in Silicon Valley.

“And you now advocate that we punish those people with higher taxes so we can reward people who made poor decisions and choices, that led them to the place they are today?”

I think you need to get your eyes checked, the nation isn’t that black and white. If it were, these types of issues could be easily rememdied.

“I cannot believe that America has become a place where the individual who takes full advantage of freedom and liberty and succeeds is now a villain to be punished, while those who do not do so are considered noble and is to be rewarded.”

It hasn’t become, it has been. As I said earlier, the tax rates on the upper tiers of tax payers in this country have never been lower than they are today. And these low rates haven’t produced the promised jobs, the stable growing economy, and has widened the gap between the top and bottom rungs of our economic ladder. It’s time to go back to the pre-Reagan tax indices.

“That is just sad, and is not the America that was intended 200+ years ago.”

Well apparently those not valuing education want to take Jefferson out of the history books as a founding father…not sure anyone has a grasp on what our country intended 200+ years ago.

No, it’s the middle income people who are made poor due to taxes 🙂

What’s so amusing about this…we levy high cigarette taxes because cigarettes are bad and we want to discourage it. Same with alcohol. Tax something we think is bad or want to discourage. Why are we surprised when our tax code is a disaster because it’s based on treating income as a bad thing?

Right Zach, if Obama wants to redistribute his own wealth, that’s great, but he shouldn’t force others to do so. Word is though he doesn’t even “spread the wealth around” in his own family.

I guess you could say I “redistribute” my own wealth through private charity (though I don’t view it that way), but it’s far different to have government force the redistribution.

He pretty much redistributed his Nobel Peace Prize money…

People have been arguing about this for decades and have gotten no where. All I can say is Beck is a nut and needs psychiatric help immediately. Why would anyone validate what Beck says by posting this sign? I find it stupid.

Frankly…I’m thinking…who cares what Jesus said? I mean…why does it matter? How does quoting bible versus and preaching about what Jesus said (as if anyone even knows what he said) help anything in this world?? I believe there needs to be a clear line separating church and state…and interjecting Jesus or God into the political discussion all the time is bothersome.

Glenn Beck’s Sermon on the Mount:

http://news.yahoo.com/comics/tony-auth