Ron Paul and the other gold bugs keep telling us how precarious our economic circumstances are and that only gold can save us. The reality? Not so much…

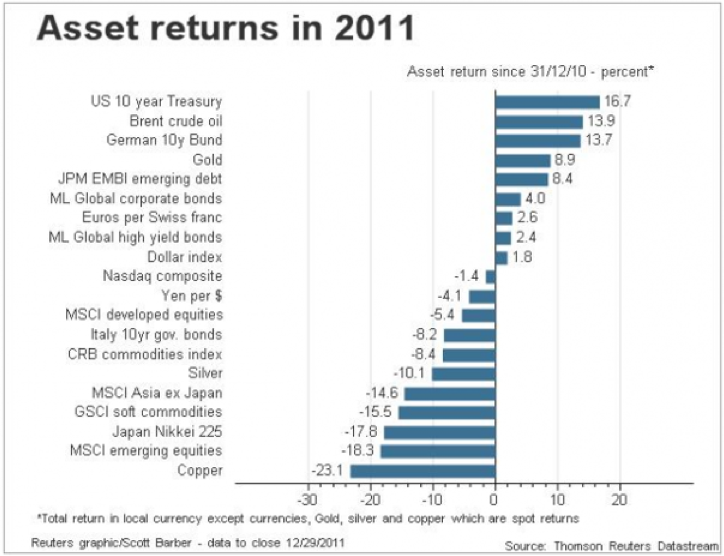

The US Bond market is set to have a banner year… again! And at least one of the bonds outpaced gold in 2011.

So much for the impending economic apocalypse.

The euro-zone crisis sent investors fleeing for the relative safety of U.S. Treasurys. Now the U.S. bond market is set to have its best year since 2008, with a 13.7 percent return — significantly outperforming the stock market in 2011. What’s more, the Wall Street Journal points out, “the biggest star was the 30-year Treasury bond, with a 35% return, far outpacing even gold, another favorite safe-haven asset.”

How many times do Ron Paul and the other gold bugs have to be wrong before people stop listening to them?

Gotta admit, until recently, I had a soft spot for the old loon. He’s one of the few that are true to ideals. Unfortunately, his ideals are a bit off kilter. Libertarianism has a lot to be said for it, IF it would account for correcting the imbalances that naturally occur in the marketplace — of ideas and economic and otherwise. If it’s possible to be a small government liberal, I’m one.