The idea that the government can “run out of money” is absurd when that government is the currency issuer. This whole concept of insolvency relies on the notion that currency is bound to a tangible asset somehow (gold, silver, kumquats). It’s just a holdover from the old gold standard. This concept that each and every bill issued needs to have a corresponding weight of gold available in the treasury to “back up” the bill. But like the appendix, it’s vestigial. Time to have it removed. Sovereign fiat currency issuers cannot go broke.

When we talk about a household budget in America, the constraint is dollars. You can only spend what you earn (plus what you can borrow on credit). We need these dollars to buy goods and services. But we, as individuals, cannot issue the currency. We are not monetary sovereigns. Money is constrained for our households (and, by extension, the States as well). But the Federal government? Not so much.

The Federal Government can, literally with the push of a button on a computer, create dollars from thin air. This is disconcerting to the gold bugs like Ron Paul because it implies that the dollars are then somehow worth less. But the reality is, dollars are a comodity and are worth what people are willing to trade for them. Dollar value is measured in the yield curves on Treasury Bills. The lower the yield, the higher the value (the higher the demand for the Treasury Bill).

The gold buggery of people like Ron Paul is actually tied to the 19th century “labor theory of value” shared by both Marx and von Misses. The value of the dollar must be tied to something extractable from the earth where value of that material is derived from the work needed to get it.

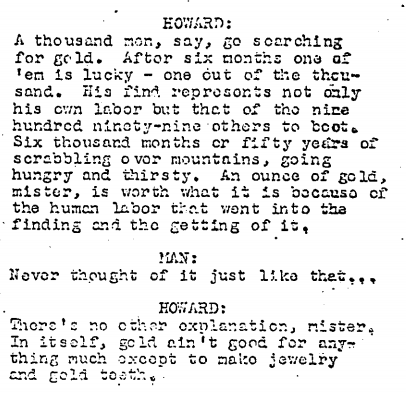

In Treasure of the Sierra Madre, the old prospector gives, perhaps, the best definition of the labor theory of value I’ve ever heard.

But as we know, the labor theory of value does not really hold water in a global system of exchange. Labor is but one component of value. And when it comes to dollars-as-commodity, the concept is even more abstract than that. So we need to put aside the gold fetishism and treat our monetary system as it really is, not how we might wish it to be.

Bottom line: The Federal Government never has a solvency problem. It may have inflationary problems, but that’s a different constraint.

Here is an excellent little video illustrating this point.

http://www.youtube.com/watch?v=mpS31Z2Ys4o

I hadn’t thought of the “labor theory of value” in 20 years, and it’s popped up twice in the last week. Weird when that happens.

But isn’t that bit from TotSM perfect? I mean have you ever heard a better definition?

It is. Current economic theory, unless it’s changed since I last checked, equates value not with the labor cost of producing it, but what people would be willing to give up to obtain the “thing” as influenced by supply and demand. Imagine a recluse spending a lifetime building a castle made of chipmunk bones. A lot of labor goes into it and it is one-of-a-kind rare, but if no one wants to take possession of it, it has no value. Now imagine a meteorite smashing right into the middle of Times Square that looks exactly like Elvis. Labor costs are zero, but everyone wants to get their hands on it so the value will be “astronomical.”

I think there’s a place for both.

That castle is in the Dells, right?

A bit further north — Fred Smith’s Concrete Park, Phillips, WI: http://bit.ly/concrete-park