TeaOP WARNING! Facts, data and statistics ahead!

I’ve written about Mike Kimel’s work on my own blog before, but I find it utterly fascinating that the Laffer Curve has vanished from the canon of the regressive tax crowd in favor of the flat tax. I guess the flat tax is the new stupid.When you actually subject the Laffer curve to analysis, the answer you get doesn’t support wingnut ideology of “low taxes equal high growth” at all. So what else is new?

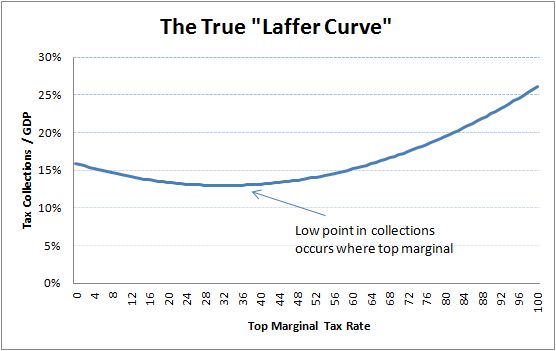

Now, it turns out that the optimal tax rate for growth is easy to calculate. The data cooperates very nicely. There is a relationship, an easy to estimate curve which I’ve modestly called the “Kimel curve.” And the high point in the Kimel curve is somewhere around 65%. Now, the Laffer curve analysis shows us that getting to the level of taxation that produces the fastest economic growth rates would also increase our tax collections… not a bad thing at all in an era of rapidly rising national debts.

Which brings us to the biggest Laffer curve joke of them all: ain’t no way the folks who like to talk about the Laffer curve would support that.

Got that? The top marginal tax rate that produces maximum revenue and maximum GDP growth is 65%. Not the 32% we have now. In fact, the 32% we have now is actually quite sub-optimal for GDP growth.

Recent Comments