Angry Bear is one of my favorite economic blogs and Ken Houghton is one of my favorite economic bloggers. He calls ’em like he sees’ em. In this case, he sees profound macroeconomic stupidity from Bernanke and Tim Geithner.In a post this morning entitled About That, er, Monetary Expansion… Ken makes three connected observations that everyone should be aware of.

- The velocity of money measure only works when money is circulating. Why is this important? Because if money isn’t moving throug the economy, it isn’t doing any work.

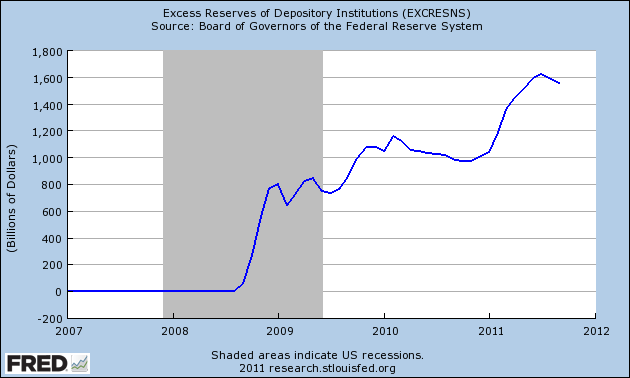

- Money really isn’t circulating as data from the Fed shows, many banks are now hoarding reserves.

- The kicker: Banks are hoarding reserves because as of October 2008, they began receiving interest payments from the Fed on their reserve holdings. This has never happened before. So, surprise surprise, banks are sitting on cash. Monetary policies only work when bank reserves are kept at the minimum level required by law (3% – 6% of deposits depending on the size of the institution)

This is an good example of “you plant corn you get corn.” When you incentivize banks to keep cash, don’t be surprised when they do precisely that.

By the time of the stimulus, roughly that amount had been taken out of circulation as the change in Excess Reserves. Even if every cent had been well-allocated, it was already out of circulation.

Ben Bernanke giveth, but Ben Bernanke taketh away even more, in spades.

What Monetary Stimulus?

Recent Comments