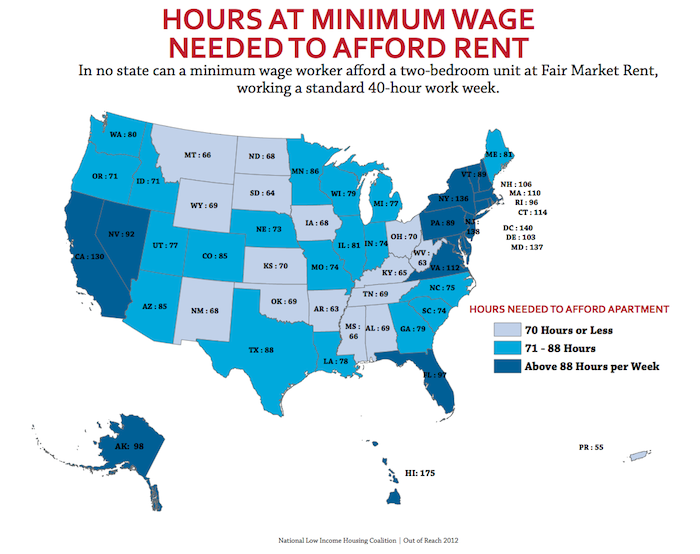

I have to thank / blame Ezra Klein for getting me back on the blogging horse. He posted a chart that really brought home the problems facing our state and our country. Most people who read this blog are, I expect, reasonably well ensconced in the American middle class. Most folks probably own their homes or, if they don’t own, rent and have no trouble making the rent month to month. I could be wrong, but I expect that that’s a reasonable assumption for most of the folks here. But I don’t think any of us realize how lucky we all are. When I see a chart like this

that shows that even in a state like Wisconsin, a family must work nearly 80 hours / week at minimum wage just to be able to afford a 2 bedroom apartment at the prevailing rate I have to question the objectives of our whole society. What are we doing that people must work 80 hours per week, 52 weeks per year just to afford a place to live? Where did we go wrong?

This chart and the associated data come from a report by the National Low Income Housing Coalition. The report states

With the number of low income renters on the rise, the argument for sustaining affordable housing assistance is timely.

- In 2012, a household must earn the equivalent of $37,960 in annual income to afford the national average two-bedroom FMR of $949 per month.

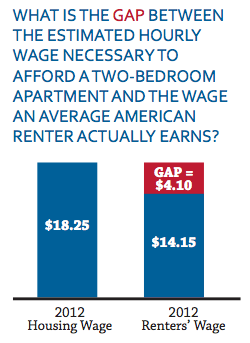

- Assuming full-time, year-round employment, this translates into a national Housing Wage of $18.25 in 2012.

- This year the housing wage exceeds the average renter wage, $14.15, by over four dollars and is nearly three times the minimum wage.

Despite the great need for affordable housing units, subsidies for critical affordable housing programs continue to face the threat of cuts, as do many social safety net programs. For FY12, HUD suffered cuts of $3.7 billion dollars, 9% below FY11 funding levels. Although HUD estimates that its public housing capital needs are in excess of $25 billion, the Public Housing Capital Fund received 8% lower funding for FY12.19 The HOME program, key to the production of many new affordable units at the local level, suffered a cut of 38% between FY11 and FY12, a cut that is estimated to result in 31,000 fewer affordable rental homes. Meanwhile, the National Housing Trust Fund (NHTF), which Congress authorized in 2008, remains unfunded. The NHTF would fund the production and preservation of homes affordable to the lowest income households. Funding the NHTF is NLIHC’s top priority.

As foreclosure pressure mounts on homeowners, former homeowners are driving the cost of renal stock up pushing lower income families into ever more marginal housing.

Imagine the insecurity this must breed in these families who can barely make it. But what about Wisconsin, you ask? Wisconsin’s Fair Market Wage, that is the wage needed to afford a 2 bedroom fair market rental is $14.23 or nearly 2x the minimum wage. In the Milwaukee / Waukesha area, that number is $15.81 or 2.2 full-time minimum wage earners.

In Wisconsin, the estimated mean (average) wage for a renter is $11.05. In order to afford the FMR for a two- bedroom apartment at this wage, a renter must work 52 hours per week, 52 weeks per year. Or, working 40 hours per week year-round, a household must include 1.3 workers earning the mean renter wage in order to make the two- bedroom FMR affordable.

The report also contains detailed data, broken down by county for each state.

Not to challenge the point because I’m all for housing assistance, but I’m not entirely convinced by the reports. It might just be that I didn’t go to the underlying report to get the detailed data. To me housing affordability is a local issue, so you can’t look at national numbers for anything more than an overall “health” (kind of like BMI being useful for aggregate data on weight but not terribly useful as an indicator for a particular person’s weight). I also wonder why a two bedroom apartment is the residence being looked at. I’m not saying I don’t think a family of three should be able to afford a two bedroom apartment, but I think those making that little may squeeze themselves into a one bedroom (or smaller) to save the money. I could be wrong. I don’t really have any insight, as I’ve never felt like I was living paycheck to paycheck, even when I dropped out of college.

In any case, in my mind affordable housing and affordable general healthcare are basic human rights (although I recognize many would disagree with me). I may not be able to convince others that this is the right thing to do, but that doesn’t make it wrong. I don’t see it as communism or socialism, I see it as the least we should do for the less fortunate. Unfortunately greed is rewarded much more than compassion. What a world we live in.

Brian, you’re quite right to challenge the assumptions of the research. First, the study uses the HUD definition of FMR or Fair Market Housing:

From what I understand, they use the standard two-bedroom apartment to adequately represent the needs of the average family. Some will need fewer and some will need more depending on how many children they have, whether they’re caring for a parent or other dependent.

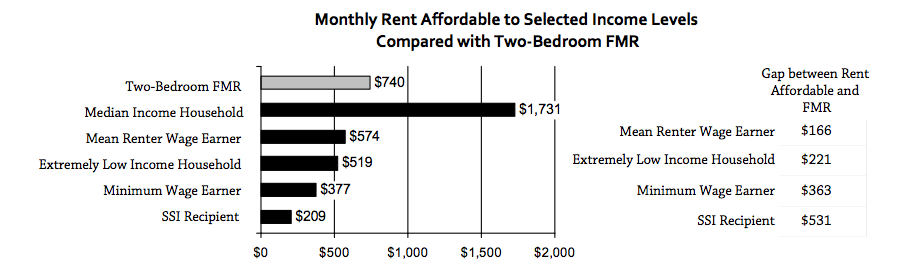

But even one-bedroom apartments are more than a single worker can earn. Look at the other data from Wisconsin:

Zero Bedroom FMR: $522

One-Bedroom FMR: $608

Two-Bedroom FMR: $740

Three-Bedroom FMR: $961

Four-Bedroom FMR: $1,054

The median renter income in Wisconsin is between $377 and $574, barely enough to afford a zero bedroom apartment!

The other terrifying statistic is that 25% of renters are ELI (Extreme Low Income), yet the stock of affordable low-income housing has actually shrunk in the last few years.

The main takeaway is that there’s a large population of Americans, many of whom are rural and hence invisible, who are being squeezed out of the American Dream.

Interesting. What percentage of income are they using to determine affordable rent value. Before I graduated from college I often spent 45% on housing even though conventional wisdom was no more than 30%-35%. I never felt too stressed, but I wasn’t feeding anyone but myself. In a well designed household budget 30% would be valid, but the extreme poor probably don’t follow the same budget percentages as a middle class household. (I may have to read the source materials after work today).

I believe the number is 30%. But remember, when you were in college, you were likely covered by a combination of your parent’s health insurance and a student health system. And you probably didn’t have kids to feed and clothe.

Yes, the percent in the report is 30%. Through a little internet research I’ve seen recommended housing percents of 25%-35% of gross (pre-tax) income. This includes all housing costs, which I presume would include mandatory utilities such as electricity and heat, but would exclude cable (and possibly phone). It definitely is an interesting report. It was written by a group with a set agenda (there’s nothing wrong with that), but they clearly state their goals and clearly define their methodology. This is more than can be said for a lot of groups which feign impartiality.

Clearly it paints a scary picture for those at the lowest end of the income spectrum. However, it is an aggregate report which will not be representative of everyone (or possibly even representative of anyone in particular). There are possibly even some making minimal wages who are able to get into housing at the 5th percentile and may be doing alright.

It was definitely an interesting read and something interesting to think about. It really would be nice if the entire country believed a minimal level of housing availability were a natural right. It’s not like the country can’t afford it. Unfortunately humanity seems to be a selfish and greedy species on the whole. Individually we may preach compassion and giving, but when left to our own anonymous actions we tend to display the true nature of humanity. Or maybe I’ve just become too cynical.